Abstract

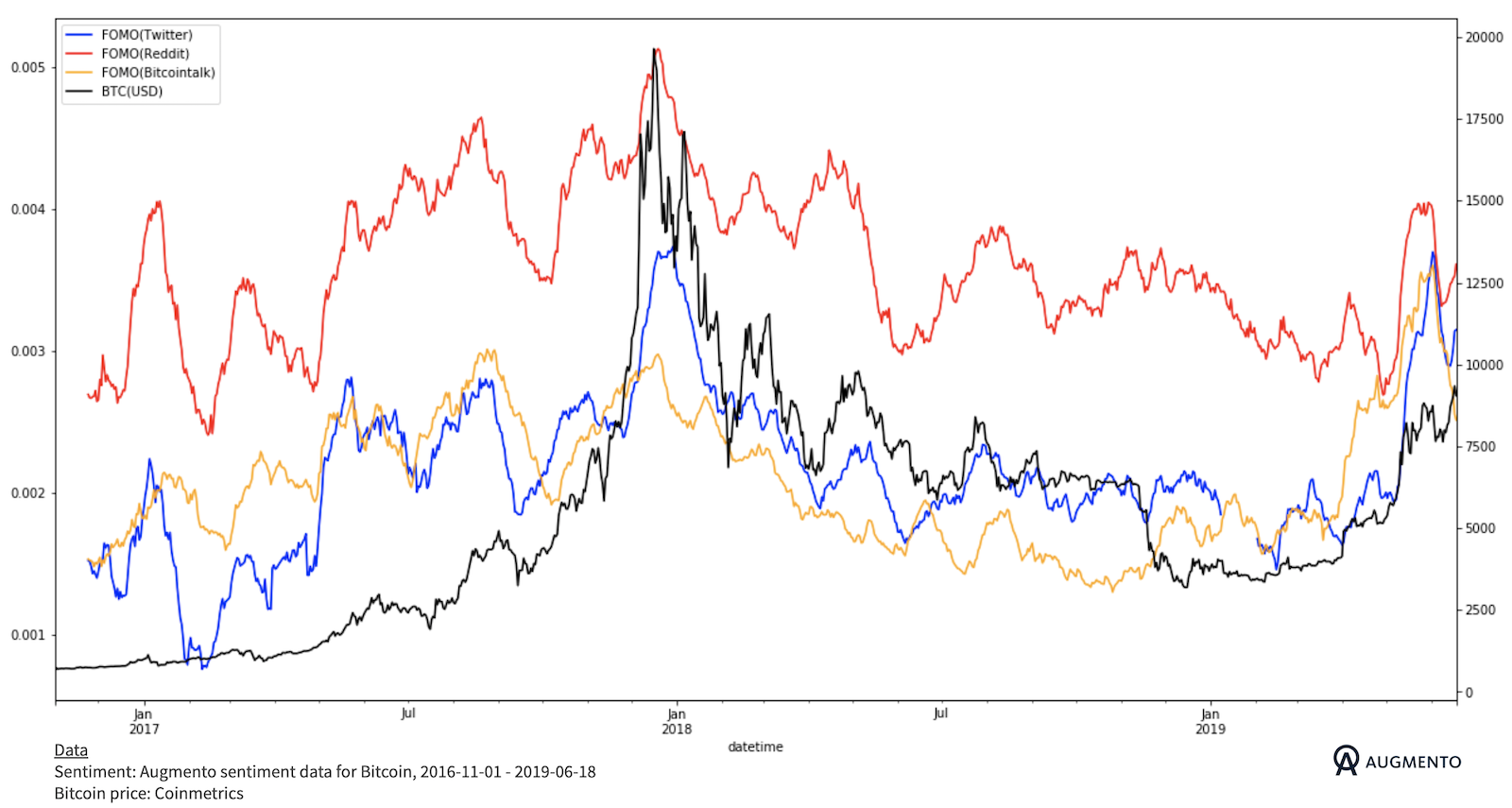

- FOMO sentiment towards Bitcoin (BTC) recently reached all-time highs on Twitter and Bitcointalk but not on Reddit

- FOMO sentiment on Bitcointalk showed extraordinary price leading characteristics in recent months for Bitcoin (BTC)

Recent discussions on social media revolved around the question: how prevalent is greed in the current Bitcoin and cryptocurrency markets? For example, market participants referred to the Crypto-Fear-Index, which has shown a new high, to illustrate that the market exhibits extreme greed.

Greed is a psychological and social concept. It is closely tied to human emotions. That is why it stands to reason that sentiment analysis can provide an insightful perspective to the greed-question. In this research, we address the question by computing indicators that measure levels of FOMO (Fear Of Missing Out) in posts related to Bitcoin on social media.

Methodology

Augmento’s AI is trained to detect FOMO sentiment in texts from crypto social media. Texts that the algorithm tags as FOMO can represent both explicit and implicit FOMO sentiment. Examples of explicit references to FOMO are “it’s time to FOMO” or “I just fomoed in” while implicit references are texts such as “did I miss the train?” or “I think I am too late”.

We connected to the Augmento API to retrieve sentiment data measuring FOMO sentiment in posts on Twitter, Reddit and Bitcointalk that mention Bitcoin (or synonyms such as BTC or BTX). We want to account for discrepancies in overall communication volume across the past market cycles. Therefore, we normalized the data by dividing counts of FOMO for each data source by the sum of all sentiment data available for Bitcoin on the respective data source. The result is data source specific FOMO sentiment indicators for Bitcoin.

New FOMO sentiment all-time highs for Bitcoin

We find that FOMO indicators have reached new all-time-highs beginning of June 2019 on Twitter and Bitcointalk. Reddit FOMO experienced a recent peak, too, however, it did not reach the FOMO all-time high of end 2017. Most interestingly, we find that FOMO on Bitcointalk, which is decreasing again at the time of writing, showed extraordinary price leading patterns in recent months.

Caveats and further research

In this research, greed in Bitcoin markets was proxied via building indicators based on FOMO sentiment. However, both the concepts of greed and of FOMO are multidimensional. That means that FOMO sentiment alone might not be sufficient as a proxy. For example, one can argue that FOMO on social media should also account for the total number of mentions of Bitcoin. Here, however, we took out this factor in order to achieve normalized levels of FOMO sentiment. Further research could build metrics that find a way to both normalize the FOMO readings and account for overall mentions of Bitcoin. Also, further analysis could compute correlations between the indicators and forward returns of Bitcoin. Finally, it should be evaluated statistically and qualitatively why Bitcointalk FOMO exhibited such strong price leading characteristics in recent months.